How to Calculate Break Even ROAS

by Joseph Jones • April 8, 2024

Needing to understand how to calculate break even ROAS?

Understanding key performance indicators (KPIs) is crucial for marketers and business owners, that’s no secret. While many KPIs can gauge your company’s success, break even return on ad spend, or break even ROAS (return on ad spend), is especially crucial for e-commerce marketing.

Here’s the deal: ROAS lets you know the exact amount your ad should bring in to offset the cost of the product or service it’s promoting.

If you don’t know this, you could be wasting your ad budget because you’re spending too much on acquiring the customer/purchase to – at the very least – break even on the spend.

We’ll show you how to calculate break even ROAS, what this term means, and why you need to keep an eye on it.

What Is Break Even ROAS?

While ROAS is calculated as ad revenue divided by ad spend, break even ROAS is when you break even on acquiring a customer.

If you want to learn how to calculate break even ROAS, you’ll want to keep this formula handy:

Ad Revenue/Ad Spend = ROAS

And you may see the more advanced calculation as well:

(Average Order Value x Conversion Rate) / CPC = ROAS

Why Is Break Even ROAS an Important KPI?

Knowing why you should know how to calculate break even ROAS is just as important as knowing how to calculate it.

To put it simply, the more revenue generated, accounting for fulfillment and fixed costs, the more favorable the outcome of your ad campaigns.

But, before diving into sponsored ads to give your e-commerce business a boost without breaking the bank, it’s important to get your marketing campaigns to the break-even point. Once you’ve hit that mark, you open the door to snagging a bunch of new customers, translating to a fatter monthly profit.

Adding sponsored ads to your growth game plan is cool and all, just make sure it’s bringing in the bucks. Otherwise, you might end up in the red.

Benefits for Calculating Break Even ROAS

But calculating your break even point goes beyond just looking at your profit margins. You need to know how to calculate this KPI so you can better understand:

- Risk Mitigation: It helps businesses identify campaigns that might be leading to losses, allowing for timely adjustments or the discontinuation of ineffective strategies, thereby reducing financial risk.

- Customer Acquisition Cost Awareness: Break even ROAS sheds light on the cost of acquiring customers. Businesses can assess whether their advertising expenses are justified by the revenue generated, contributing to a more informed approach to customer acquisition.

- Long-Term Planning: By understanding the break-even point, businesses can engage in more effective long-term planning. This includes setting realistic expectations, adjusting marketing strategies, and planning for sustainable growth.

- Competitive Advantage: Utilizing break even ROAS provides a competitive advantage. Businesses can stay ahead by fine-tuning their advertising strategies, making data-driven decisions, and adapting to market changes more effectively.

- Customer Lifetime Value Consideration (CLV): Break even ROAS allows businesses to factor in the long-term value of customers, helping them assess the overall impact of advertising efforts on customer retention and loyalty.

Bonus: Break Even ROAS Helps You Pivot Your Campaigns

Aside from the advantages we’ve covered so far, break even ROAS can help you determine how to pivot after launching a campaign.

Let’s assume the break even ROAS for a campaign is set at $3.

Now, if the actual campaign ROAS exceeds $3, the ad campaign turns out to be profitable. In this scenario, consider boosting the campaign budget to outshine competitors and enhance the conversion rate.

On the flip side, if the ROAS matches the break even ROAS, you might want to cut down bids on keywords or lower the Cost of Goods Sold (COGS) to steer the campaign toward profitability.

If the actual ROAS falls below $3, indicating a loss in the ad campaign, you should take action to correct it. To prevent squandering ad spend, consider either pausing the campaign or optimizing it to boost the ROAS.

That being said, a low ROAS doesn’t necessarily spell trouble. If your objective is to boost brand awareness, running campaigns with a ROAS below the break-even point can be strategic for gaining more impressions and increasing product visibility.

There are instances where a low ROAS is advantageous, such as when ads contribute to an increased CLV by driving repeat purchases. In such cases, a campaign with a low ROAS but a high CLV is far more valuable than a high ROAS campaign with fewer sales.

Using a Break Even ROAS Calculator

As marketers, we know how hectic the day can get, and a quick and convenient way to calculate break even ROAS is nothing short of a gift.

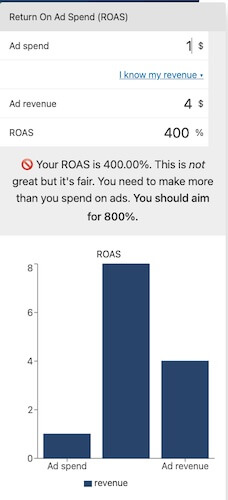

Omni Calculator features both a simple and advanced break even ROAS formula input option and even shows you a bar graph, along with some tips on where you should aim to be to improve your revenue.

What Can Affect Your ROAS?

If you’re not seeing break even ROAS, you may want to look into what could be affecting your results. Here are just a few things to consider:

- Brand Popularity: If your brand is new in the market, your ROAS is likely to be lower compared to when your brand is well-established.

- Type of Advertising or Ad Source: The choice of advertising, such as banner ads, may result in a lower ROAS since banners are less likely to be clicked. However, they can effectively enhance brand awareness.

- Campaign Performance: If you’re entering a new market and your ROAS is below 300%, it’s advisable to review your audience targeting and optimize your campaign for better results within your marketing budget.

- Customer Reviews: The perception created by customer reviews can influence your ROAS, reflecting the impact of public opinion on your advertising success.

- Product/Service Description and Images: The way you present your product or service, including descriptions and images, can play a role in shaping your ROAS.

- Product Price: The pricing of your product is a significant factor, affecting the perceived value and, consequently, the ROAS.

Is Break Even ROI Different?

We’re glad you asked, because yes, there is a difference.

While Return on Advertising Spend (ROAS) specifically measures the return on investment for an individual advertising campaign, break even ROI assesses the overall return on investment.

In essence, ROI provides a comprehensive evaluation, whereas ROAS is a targeted metric focusing on the performance of a singular advertising campaign. Notably, advertising costs are the sole expenses factored into the ROAS calculation.

Is Break Even ROAS Good?

To put it simply, breaking even on your ad spend isn’t something to scoff at.

To most marketers, having a killer Return on Advertising Spend (ROAS) is when it takes care of all the ad costs. Break-even happens at 100% ROAS. If you’re cruising above 400%, you’re doing pretty well, factoring in sneaky expenses like vendor fees. Now, if your ROAS hits 800% or more, you’ve got yourself an awesome ROAS that’s got your business costs covered.

There are exceptions, and not all businesses are the same. For example, a business in the apparel industry typically deals with smaller profit margins, so breaking even here is a huge win. If your company sells products or services that are meant to be long-term investments, you may want to go beyond the break even point.

All that to say, if you’re breaking even, you’re on the right track.

Are You Breaking Even?

Break even ROAS requires a comprehensive consideration of all advertising expenses to provide an accurate depiction of your achievements. It helps fine-tune your advertising endeavors and overall marketing strategy and makes sure you’re not hemorrhaging money.

If you’re still struggling with grasping your break even point when it comes to ROAS and ROI we’re your people. Reach out to us today and let’s chat!