Marketing Small Business Loans During COVID-19

by Aden Andrus • April 23, 2020

COVID-19 has hit the economy hard. According to some estimates, this novel Coronavirus has put more than half of American jobs at risk.

Things are particularly dicey for small businesses, who are both more likely to be directly affected by things like a nationwide lockdown and are less financially stable than larger corporations. It’s a sad, hard time for business owners—many of whom are struggling just to survive.

Fortunately, though, there is some good news.

COVID-19 won’t last forever. If businesses can just survive until the end of the Corona-pocalypse, there’s a good chance that they’ll be able to recover. Things might not go back to “business as normal” right away, but it’s better than losing everything.

This is where small business loans come into play. Business loan providers have a key role in helping small businesses get through this crisis. Between government-funded payroll loans and regular business loans, there are plenty of options for small businesses—you just have to get the word out.

But how do you do that? A lot has changed in the past few weeks, what’s the best way to get in front of your target audience and convince them to use your services?

Well, you’re in the right place. In this article, we’re going to cover all of that in detail and help you make the most of this unique situation. Let’s get started.

Invest in Paid Search Advertising

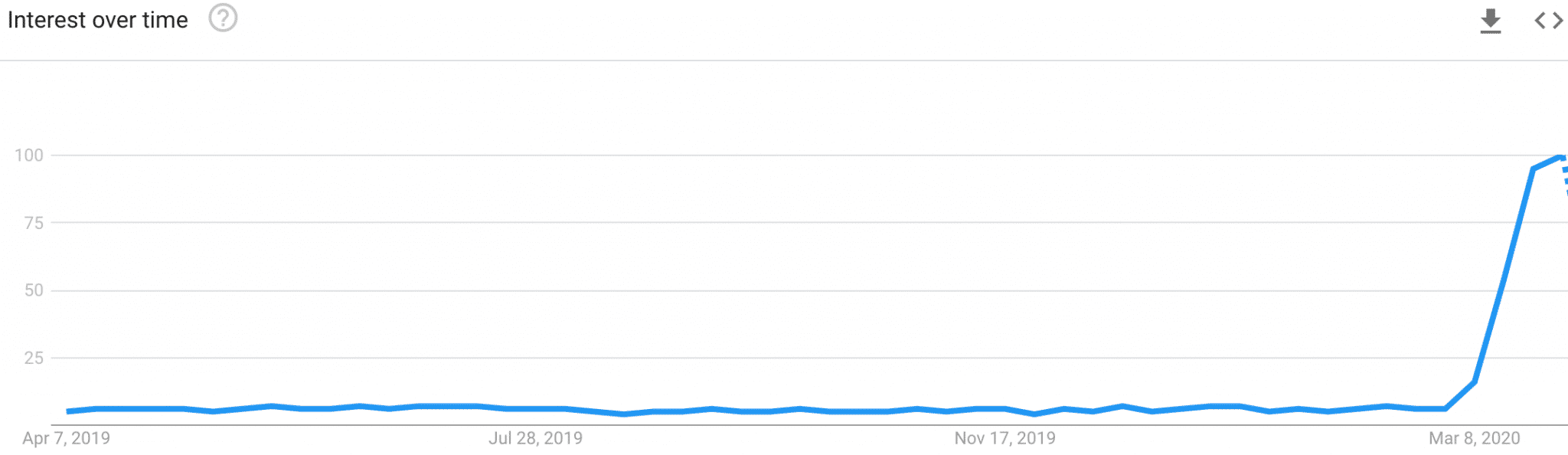

Right now, more businesses than ever are searching online for business loans. Just look at how the trend data for the search term “small business loan” has spiked over the past few weeks.

With paid search ads, your potential clients are out looking for solutions. This massive spike in search traffic isn’t just people searching out of idle curiosity. These are small business owners in need—in desperate need of the help you can provide.

Right now, if you’re not advertising on Google and/or Bing, you’re missing out on a huge opportunity. Even if you are already doing paid search advertising, it’s more important than ever to expand and refine your marketing efforts.

After all, if you don’t seize this opportunity, you can bet that your competitors will.

With all of that in mind, let’s talk about how to set up your paid search advertising. Here are some ideas to help you get started:

Create Ad Groups for Each Lending Product

One common mistake that many small business lenders make is trying to gather too many ideas under one campaign or ad group.

People use different search terms for different reasons, and someone who is looking for a “payroll loan” has very different priorities than someone searching for “business line of credit”. As a result, they’ll respond to different messaging and selling points.

If you try to address all of those differing needs and objectives with a single ad group and landing page, you’ll never get the kind of results that you need. It takes more time and effort to build out different campaigns and ad groups, but you get much better performance, so it’s well worth it.

Use Landing Pages

Along the same lines, you don’t want to do a great job of using ad groups and campaigns to deliver targeted ads…only to send your clicks to a generic landing page (or worse, your home page).

Your landing page should be a natural extension of the messaging in your ads. If your landing page doesn’t fit the specific needs and goals of a visitor, they’ll bounce…leaving you to foot the bill for their click.

If you want people to convert after they click, you need product-specific landing pages that build on the messaging of your ads and convince people to take the next step. Again, this takes more work, but it produces far better results.

Target the Competition

Odds are, you’re not the only lender your potential customers can use. With that in mind, you’ll want to create ads that target the branded terms of your local competitors. That way, you can piggyback off of their marketing efforts and get your hat in the ring.

The trick here is to target the competition’s brand name and other branded terms…but leave those terms out of your ads themselves. If you use someone else’s copyrighted terms, Google will shut your ads down.

Advertise on Bing

Google Ads is the king of digital marketing platforms. There’s no arguing with that, but that doesn’t mean that you should ignore Bing Ads. It might not have Google’s reach, but Bing is still used by a significant number of people.

To make things even better, there’s less competition on Bing, which means cheaper clicks and less potential comparison shopping. If your competitors aren’t advertising on Bing, it’s a great channel to test out.

Run Remarketing Ads

Taking out a business loan is a big deal—especially when you feel like your business might go under. It’s not a decision people take lightly, which means that it’s also not a decision they’ll rush into.

So, if people don’t convert the first time they visit your landing page, don’t worry. With the right remarketing strategy, they’ll be back.

Remarketing allows you to keep display ads in front of people who have already responded to your remarketing message once. With the right strategy, you can use remarketing to address their concerns and get them ready to convert and eventually take out a loan.

It’s a bit of a longer process, but it’s usually quite affordable, so if you aren’t running remarketing ads, you’re missing out on sales.

Social Media Advertising

In addition to running ads on Google (and Bing), it’s also a great time to run ads on social media. Your potential clients are spending more time than ever on social media right now, so it’s a great time to get on their radar—even before they’ve decided to look into small business loans.

For small business loans, Facebook and LinkedIn are the best place to advertise right now.

Facebook is the world’s largest social media network, so business owners are spending a ton of time there connecting with their friends and family. LinkedIn, in contrast, is the world’s largest professional social media network. Your clients are spending a lot of time there connecting with other professionals and trying to figure out how to keep their business afloat.

As a result, both of these platforms are ideal for small business loan advertising. Not only is your target audience spending a lot of time on these platforms, but you also have a variety of targeting options you can use to get your ads in front of them.

Right now, there are three key things you should be doing with your paid social media ads:

Directly Market Small Business Loans

For some businesses, they are feeling the heat but things haven’t gotten hard enough that they’re ready to start looking for a loan. This is the perfect time to get in front of them and show them just how easy it is to get small business loans from you.

Other businesses are looking into loans, but haven’t yet decided on a lender. Even if they didn’t click on your ad while searching on Google, they might click on your ad on Facebook or LinkedIn.

In either case, your ads should be designed to convey ease and value. Your audience is dealing with a lot of stress and difficulty right now—your job is to make getting a loan as simple and intuitive as possible. The easier people think it will be to get the money they need, the more likely they will be to want to learn more.

Educate Your Customer Base

Many small businesses aren’t aware of all the options in front of them. They know that they need (or might soon need) a loan, but the process feels overwhelming.

For these customers, if you can show them what their options are and the strengths and weaknesses of each approach, you’ll become their best friend. And, if you can explain things simply and clearly for free, it’s natural to assume that you’ll be a great lender to go with, right?

This approach is all about creating value first. The more value you offer for free, the more likely people will be to take advantage of your services. This sort of approach works particularly well when combined with social media retargeting ads, which we’ll get into next.

Run Retargeting Ads

As with Google and Bing Ads, you can also run retargeting campaigns on LinkedIn and Facebook. The great thing about this is that you can actually retarget people who originally found your site on Google. It’s the perfect way to ensure that your business stays on a potential client’s radar until they actually convert.

Of course, the reverse is true as well. You can remarket to people using Google or Bing Ads who first visited your site from Facebook and LinkedIn. In fact, you can even set up search campaigns targeting people who have already visited your site, which can help you save some money on paid search clicks.

Overall, retargeting (or remarketing, if you’re using Google) is the best way to get the most out of your marketing efforts. Not everyone will convert the first time they visit your site, so it pays to keep your business in front of them until they do.

Conclusion

Paid search and paid social ads aren’t the only way to market small business loans, but with the recent spike in demand, small business lending has become incredibly competitive. For now, the best way to get in front of your target audience and stay there is with paid advertising.

If all of this feels a bit overwhelming and you’d like some extra help, let us know here or in the comments! We’d be happy to audit your accounts for free and show you how to make the most of this unique situation.

How are you approaching small business loan marketing? Have any tips to share? Leave your thoughts in the comments!