Saved by the ROI: The Small Business Owner’s Guide to Return-on-Investment

by Ed Challinor • April 24, 2018

Measuring marketing ROI isn’t hard…it’s really hard.

And it’s a fact that most small business owners not only incorrectly measure ROI, they also have limited financial clarity and incorrectly measure pretty much all of their figures.

As a successful local dentist in Liverpool, I’ve helped hundreds of dental practices grow here in the UK and in the US—as well as working in Entrepreneur organisations and Mastermind groups.

Drawing on all of that experience, I’ve put together the following comprehensive how-to for measuring small business and SME ROI.

ROI and Financial Clarity

The concepts of ROI and ‘financial clarity’ are inextricably linked.

In this article, I’m going to show you how to measure ROI effectively, how to get financial clarity and and how to use your financial results to ensure you’re getting the ROI you deserve so that you can lead the life you imagined with a business that makes you happy.

ROI Lesson 1

Without financial clarity, you cannot hope to calculate an accurate ROI and are flying blind.

Now, I’ll warn you in advance, this is not a ‘10 ways to make loads of money’ article. It’s a very deep dive into the intricacies of business finance that have allowed Smileworks, a little dentist, to grow from £0-£1.5M revenue in under three years.

Our profit margin is insane. But this level of success is not easy to achieve. Nor is it simple. There are no hacks, tricks or ‘ten things’—and it certainly can’t be crammed into 750 words.

So, get a cup of coffee and let’s get started.

Remember failing isn’t cool. It’s not a badge of honor that entrepreneurs should be proud to wear. It’s a terrible, crippling waste. And in this article, I’m going to teach you how to avoid it.

My Story

Smileworks (https://www.smileworksliverpool.co.uk) is easily the fastest growing dental practice in Liverpool, a City of 2.2M people with some punchy and well-funded competition. Yet we’re the ones killing it.

So much so that our direct competitors are selling up or going out of business!

I’d like to take the credit—but it’s not just because we’re good at what we do. These businesses have killed themselves by abdicating financial responsibility. By being arrogant and greedy. They’ve not engaging with digital advertising and wasted hundreds of thousands of pounds without calculating the returns.

Since Smileworks is doing fairly well, when I asked Chad at Disruptive about ROI for my AdWords campaigns I thought he’d just say, “oh it’s this much”.

But instead, he started asking me for all these numbers that I just didn’t know. So I called my accountant. And guess what? She didn’t know them either. Neither did my book-keeper. Nobody knew!

That seemingly straight-forward AdWords campaign (a conversation with my account manager, Chad, at Disruptive Advertising, actually) uncovered a much deeper problem at the heart of the dental practice I run here in the UK. This led me to start asking questions of other business owners about ROI and their financials generally.

What I found astonished me.

Almost everybody I spoke to was struggling to measure ROI. But you have the numbers, I thought, so why are you struggling to make the right decisions?

I found many—including me—were looking in the wrong places for answers to these questions. We were looking at the marketing numbers not the business numbers and were losing ourselves in CPA and lead cost and click-through rate. Sound familiar?

How to Grow a Small Business by Understanding ROI

This one’s easy, right? We run marketing campaigns to acquire more customers who pay us money (revenue) and we turn that revenue into profit and cash.

ROI Lesson 2

The financial health of your company is not Chad’s responsibility. It’s not even your accountant’s responsibility. It’s yours and yours alone.

Let’s start by taking a look at your marketing funnel.

The Marketing Funnel

So let’s look at how a marketing funnel works. You’ve all seen these. Ranging from Keith Cunningham simple to Frank Kern ridiculous.

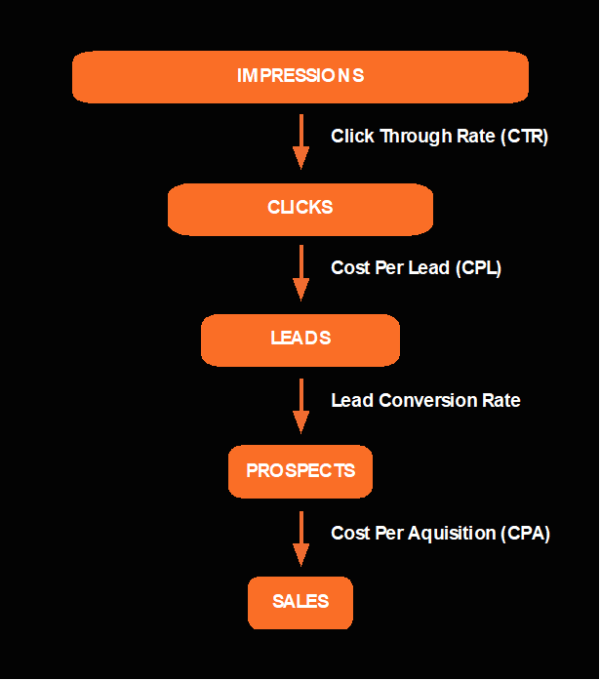

This is the basic ‘marketing funnel’ that everyone understands:

The numbers at the top are big and get smaller as you go down the funnel. The ratios between the different stages have names.

You understand them because they’re splashed all over your Facebook ads manager and your AdWords interface. Ever notice how everyone wants you to know these numbers? That always made me think…

Here’s the thing, can you calculate ROI from these numbers? That’s a hard no.

The Business Funnel

So, let’s look at how a business works. This is a different funnel altogether—one that is your responsibility and something that most people just don’t consider.

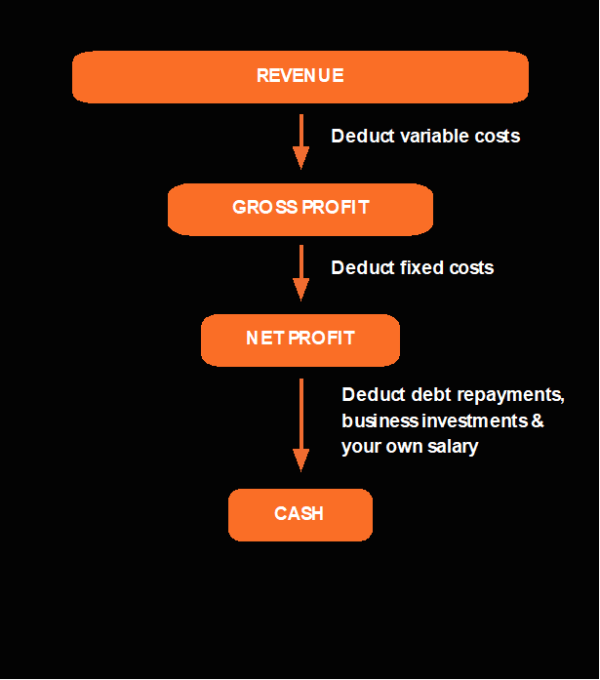

You’ll have heard the maxim, “turnover is vanity, profit is sanity and cash is king”. Well, this diagram explains what that means:

These ratios also have names and equations and mathematical formulas—but you won’t find them anywhere on Facebook or in the (now brightly colored and playschool-esque AdWords interface).

Nope, you’ll find them in your management accounts. Don’t have management accounts? Don’t panic.

I take that back. Panic. Then go and get management accounts. Or at least a bookkeeper who can work Xero or QuickBooks. This is your first step towards financial clarity.

The ratios you’ll find in these tools are similar to the publicly available ones investors use to decide on the financial health of a company they may wish to invest in. So, no prizes for guessing that these are also the ratios you should be looking at inside your own company to determine its financial health.

ROI Lesson 3

This is *not* marketing. This is *not* the responsibility of your marketing agency. And without these ratios, ROI will elude you indefinitely.

How your business turns sales into profits has nothing to do with your marketing campaigns and is vital information you need to give to your agency for them to do an effective job.

So how does business finance work?

The difference between limping from month-to-month and creating a business that’s thriving is right here in this paragraph. So please don’t give up now.

Put simply, you have your revenue at the top of the ‘Profit and Loss’ Scorecard. Underneath is Cost of Goods Sold (COGS). This includes all the variable costs used to make those sales. So marketing, freelancers, shipping etc.

What’s left is the gross profit and the relationship between gross profit and revenue is the gross profit margin. So far, so good?

Once the gross profit is calculated you must then deduct all the fixed expenses These are SAAS products, registrations, subscriptions, staff wages, insurance and all your costs that don’t change from month to month.

This leaves you with the ‘bottom line’ or the net profit.

Again, no prizes for guessing the ratio between net profit and revenue is called the net profit margin.

The gross profit is variable. Have a big month and you’ll have lots of revenue but higher variable expenses. The fixed costs are fixed. So they kind of stay the same each quarter.

This is important because you need to be breaking free of your fixed expenses figure and blasting past your ‘contribution margin’ each month to have a happy business. Stay too close to that breakeven and life becomes intolerable.

The answer? Cut costs.

Go down part two of the P&L line by line and cut the crap. Do it now, in many companies $1 saved is equivalent to $10 earned. So when you think of it like that—you can save a LOT of money by cutting costs.

Profit and Cash are Not the Same Thing

Profit is not the same as cash. Many people I’ve spoken to on my journey towards financial clarity ask the same question. They say, “my accountant says our company made £125,000 profit last year, but I only saw 10k of it in my bank?”

Don’t worry—nobody is stealing from you.

ROI Lesson 4

Profit is not the same as cash.

And guess what? There’s a scorecard called the ‘cash-flow statement’ that deals with the conversion of profits into cash. There’s also a ratio. It’s like apps. There’s a ratio for that. And in this case there’s five.

Do you know how to read your cash-flow statement? No? Thought not.

So consider this. How do businesses go out of business? What actually sinks them? It’s running out of cash, right? So the last thing you do is make sense of the cash-flow statement? That’s madness. Have you ever tried to pay your staff or AdWords bill with profit? I thought not.

What is ROI?

Now that we’ve discussed business ratios, I want you to think of your marketing in terms of ratios. So, what’s the return on investment? What’s the ‘marketing net profit margin’ (I just made that one up…and I encourage you to make up your own ratios to suit your business).

The one I use is total marketing investment divided by net profit. That’s pretty common.

But some people use marketing investment divided by gross revenue. This is an extremely dangerous measure of performance. And one that’s killed many a company.

The magic word here is investment. Advertising is an investment and needs to obey the basic rules of investing.

This is something marketers and decision-makers seem to gloss over. They make decisions whimsically and without any critical thinking or analysis.

Do you think that’s how Warren Buffett or Ray Dalio make investments? On a whim? Without looking at the financial health of the company? Do you think Billionaires just wing it?

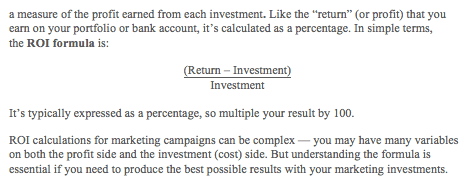

ROI is defined by Investopedia as:

The important words here are “many variables on both the profit and investment side.”

Profit and Investment Variables in ROI Calculations

So let’s dive into some of these variables. One measurement—and the fatal mistake I see so frequently—is to use revenue and not net profit in your calculations.

I can’t believe the amount of times I hear things like, ‘I spent $1,000 on Facebook advertising and made back $2,000 in sales.’ My marketing ROI is 100% right? Wrong. It could easily be negative and you’re potentially sinking your own business without realizing it.

If you use net profit as your ‘variable on the profit side’ , your ROI suddenly becomes much less than you though and you can end up losing money by growing your customer base.

What’s that? I can lose money growing my customer base?

ROI Lesson 5

More businesses go bust growing than in any other way.

Growth (especially high growth) is dangerous. Growth consumes cash and running out of cash is what kills businesses. It’s called ‘overtrading’ and unless you understand the financials in your business then your true ROI is always going to be impossible to calculate until it’s too late.

So what about variables on the investment side?

Is your agency fee lumped together in variable marketing costs or hidden somewhere else on the P&L in ‘subscriptions’? This will skew the results.

Are you factoring in the combined effort that it takes to turn a lead into a customer, like sales teams and software systems? Attributing costs to the investing side can get extremely complicated.

And, even as a CMO, we sometimes want to hide the true cost of our marketing activities in all sorts of places in the financial scorecards.

I’ve done this myself. I called it ‘Website Costs’ in the fixed costs but it was really ‘Digital Advertising’ and should have been in the COGS. I was embarrassed about how much I’d spent and wanted to hide it.

If a CEO can do that, think how many of your people might be doing it right now if you don’t have financial clarity?

Your Job Title is ‘Resource Allocator’

Business is about making decisions and those decisions relate to the allocation of resources. I think it was Warren Buffet who said that business is a game. And you need to know the score.

To know the score you need to be able to read the scoreboard to determine the winners and losers.

The scoreboard of a business is the three financial scorecards, the P&L, Balance Sheet and Cash Flow Statement. If you can’t read them, you don’t know whether your marketing activities are causing you to win or lose.

You need to gather this data each quarter or each month. I know for a fact that you’re looking at your AdWords, Google Analytics and Facebook numbers every DAY. Then you stupidly wait an entire finical year to see whether this activity has made or lost you money…more madness.

Oh, and did you get first round equity funding?

Congratulations! Statistically speaking, you’ve more than doubled your—already very high—chances of failure. It’s time to start taking this seriously It’s time to read on.

So what’s the good news? (Spoiler: it’s CLV)

So, with all this complexity and changing the way we look at our marketing spend, things are going to look pretty bleak for poor old Chad right? Wrong.

At Smileworks, our initial marketing attribution models (variables on the profit side) accounted for first and last interactions (for more on that, check out this article) and we were using a one month attribution window.

If the marketing spend hadn’t yielded any revenue and profits after a month (our average sales cycle) then we’d write it off. This was pretty harsh on Chad and the team—but I liked to keep them on their toes.

So, with this model, you might say we were only just making profit. We were using ad spend + agency fee and profits as the numbers in the ROI calculation.

But, I wanted to grow my patient base and knew these patients would be back.I knew that if we were breaking even and acquiring patients, then we were winning because the cost of a returning patient is technically nothing.

When I came back to the numbers a few months later, I saw that those patients had in fact returned for other treatments and a new symbol appeared in my ROI equation: Customer Lifetime Value (or CLV for short).

This is something it’s pretty difficult for a dental practice to measure, but if you’re using a subscription model like an agency or a business where people pay monthly, then it’s much easier and you can use it straight off the bat if you know your retention numbers.

As it happens, those early ‘barely breaking even’ campaigns—because they were so tight and well managed—produced a cohort of patients who are still with us today and making up a good percentage of our revenues and profits.

ROI Lesson 6

Learn when to measure and how to attribute

So, on a long-term attribution window (different profits side variable) of one year, the ROI% is now in quadruple figures. And now that I know the numbers, I can forecast better and know that the long term ROI of a ‘barely breaking even’ campaign is actually massively positive.

The ROI Cowboys

Getting small businesses to part with big money is huge business. And some players want to obscure the figures to help you waste money with them.

Here are some things to keep in mind and watch out for:

Bad agencies

There are just so many. They want your money every month. They want you to think they are indispensable and without them you’d be nothing.

The temptation to over-egg the results is always there.

Bad agencies are the main culprits for spreading information that makes them appear to perform well when they are not. Without financial clarity, you’re leaving yourself open to abuse from criminally crap agencies. I’ve experienced this first hand.

Marketing Platforms and Channels

These are not the street criminals above, but the brainwashing, highly funded and partly good, partly evil Illuminati of the digital world.

This group covers everything from the fake likes scandal at Facebook to the hopelessly inflated ‘3 second video views’ scandal (also at Facebook) to the way these platforms are now investing large amounts of money into going directly to small business users and trying to teach them how to basically waste money on small and ineffective campaigns.

They’ve created an addictive little game.

Facebook is particularly guilty here. There numbers are there to get you ‘addicted to spending’…not to help your business succeed. It even has a name, ‘gamification’.

That’s scary stuff, because last time I checked, the livelihoods of my 26 employees and the continuing care of my thousands of patients was no game.

Local Advertisers

Other ROI offenders to keep an eye on are local cowboy advertisers like radio and TV stations. If you believe what they’re selling then you need your head examined.

ROI Lesson 7

Don’t go on the radio or in print—and please show me your fab results if you have any and we can play a game of who’s really got the best CPM… ed@sexydentistry.com. No agencies and no haters please—these are my honestly held views and I’m here to help you.

Radio and TV are dying. And, like wounded animals, they’re becoming aggressive and unpredictable. They consider your business ‘easy money’ and use dodgy ‘independent’ stats and inflated (or just made-up) readership numbers to get your attention.

But, if you dig deeper, you’ll find that some of the highest CPMs and most dramatic advertising failures in history have been on the local radio and TV.

I ran a campaign for International Women’s day with Capital FM here in Liverpool and it cost me £4,200 and brought me 50 emails to add to my list and 7 clicks to my website.

I’ve seen no bump in direct visits to my site or any additional statistics (and believe me I’ve been looking hard) that show me that anyone cared about the campaign or was actually even listening.

At the time of writing, I’ve asked for half of my money back and haven’t heard back from Capital FM for three weeks—that’s how much they care about their advertisers.

Avoid TV and radio at all costs. I also had someone from a BIG local newspaper who openly admitted ‘readership is moving mainly online’. So I politely showed him the door.

The Problem with AdWords

I don’t consider AdWords to be playing these games. But, that doesn’t make them perfect either.

The problem with AdWords is that with reliability, transparency and real-time reporting comes cost and complexity. AdWords can be expensive. It’s nowhere near as expensive as Radio or Print, but expensive for some smaller businesses.

I’m going to be brutally honest and tell you that once Disruptive had set up my AdWords campaigns, I tried to cut them out. I tried to take over and do everything myself to save my agency fee and increase my ‘marketing margin’, expressed as:

[1M attributed Profit – (Ad Spend + Agency fee)] / [Ad Spend + Agency fee]

I mean how hard can it be? I have three university degrees including an LL.M Corporate Law Masters Degree from Nottingham Law School here in the UK.

That’s not a million miles away from getting a masters from Harvard Law…

So, I promptly sacked poor Chad and had a crack at running AdWords. It wasn’t an amateurish attempt either, I got advice, did courses and read books on how to succeed. However, despite a great deal or researching, I very quickly become totally overwhelmed with its sheer complexity and nuance.

A Good Agency is Worth It

It was at this point I came crawling back to Chad who cleared up the mess and got things back on track. He even told me where I’d gone wrong.

You can’t buy that sort of authenticity these days. It reminded me about how much our team cares about fixing up Smileworks patients when they go off an do similarly stupid things.

AdWords is extremely complicated.

Sure, they’ve got a new ‘user friendly’ dashboard with brighter, childish colors that makes it appear simple—but it’s not. Their attribution models, the myriad of bidding strategies and multitude of add-ons and rich results make them an almost impenetrable platform for us mere mortals to fathom.

I’ll tell you this for nothing. Really great ROI results come from hard-won relationships and leveraging years of expertise. You need people who’ve grown up with AdWords, who’ve seen it develop and morph into the monster it’s now become.

You need people who are constantly talking to the development team at Google and who are getting trained and coached on the new developments that can deliver you the best results.

And you need to give them the numbers to put in the system so that it can spit our profits and cash.

This is where Disruptive has helped us achieve our marketing objectives. This is where they’ve directly influenced our lives and the lives of our patients. You can’t put a price on that. Although we obviously did…

How to Mess Up ROI Calculations

I’m continuously horrified at how managers and decision-makers launch into a marketing campaign after:

- No research whatsoever into short or long term ROI or attribution modelling

- Blindly following the biased advice of the person trying to sell you the marketing

- Not having financial clarity and not understanding the margins relating to different products or the ratios relating to different business activities. Sure this is a big job, but this is your job if I’m not mistaken? I read “CEO & Founder” – on your business card. Now start acting like it.

Launching into advertising and hoping everything will be okay is a surefire way to waste a ton of money (you’re smoking Hopium, kids).

How to get it right

So, how can you get it right? How can you grow a practice or business from £0-1.5M in revenue (that’s GBP) in less than three years. Here’s how:

Gain financial clarity

If you hope to measure effectively, you need to look past just the lead cost and interrogate how your business is converting customers into cash.

Find the right agency

This is an easy one. You’re on their website right now. There are other great agencies like “Brainlabs” here in the UK. Their agency fee starts at £5,000 / month.

Or, if you’re really small, then you can get a freelancer who’s working for one of the big agencies and also doing work on the side. But beware. Some of them are complete jokers.

Figure out the aims of the campaign

Your agency will help you with this, but you need to have some idea of where you’re going.

I’m not a fan of the ‘Christopher Columbus” Marketing Campaign. That’s the one where you set out not knowing where you’re going, then when you get there you’re not really sure where you are. Then when you arrive home you’ve no idea where you’ve been. That’s not how we roll.

Determine what, how and when to measure

Attribution windows, short term and long term ROI and the ROI variables are important here. You need to set in place a system that works for you based on what you want to achieve.

Continuously measure and communicate

Measure the ROI. Don’t just blindly trust the stats coming from the platforms or from your agency. You need to measure the real profits derived from your investment.

Fail to do this at your peril.

Also, keep in touch and keep top of mind at your chosen agency. Remember, your consultant has lots on her plate and you are one of many. So keep to the program of communication and don’t just take, but also give back. Build the relationship and become a valued client who your agent will simply not allow to fail.

Summary

ROI is not a number inside AdWords or on Facebook. It’s not a number you can get from a SAAS system or even from your accountant. It’s nowhere to be found on Xero or in QuickBooks either.

ROI is something with a multitude of variables that is as unique and exclusive to your business as you are.

So, to find i’s true value for any marketing investment, you need to understand the intimate financial DNA of your company.

You can gain financial clarity by reading books from Amazon. So there’s no excuse here. But don’t go to your agency and ask them to do the impossible by calculating ROI on your campaigns without the vital numbers they need from you to build a picture of whether you are winning or losing.

I feel for many agencies when things go south because in most instances it’s nothing they’ve done but something you’ve done. Something you’ve miscalculated, something you’ve not considered or something you’ve guessed wrongly.

Or, in most cases, failure to work effectively with your agency is borne out of your unconscious decision to not only ‘outsource advertising but to ‘outsource responsibility for the success of your own business’.

This—in my view—is the reason so many businesses fail in 2018 and I hope this article gives you some insight into the work you need to do to grow safely and create a business people want to become a part of that can give you the life you deserve.