How to Create an Effective Finance Marketing AdWords Campaign

by Aden Andrus • March 29, 2017

If you’re running a finance marketing AdWords campaign, you’re probably well aware of just how hard it is to succeed at online marketing in the financing sector.

However, the fact that AdWords advertising is hard doesn’t mean that it isn’t worth it. In fact, for our financing clients, AdWords is one of their primary sources of new business.

At Disruptive Advertising, we’ve spent years helping our clients succeed in the financing sector with AdWords. After managing millions in ad spend, we’ve gotten a good feel what works and what doesn’t.

With all of that knowledge and experience under our belts, we’ve discovered that there are 3 basic obstacles that a financing business must overcome to succeed with AdWords advertising: targeting, time, and tracking.

In this article, we’ll discuss of these “3 T’s” and how to use each of them to create AdWords campaigns that drive profitable revenue for your financing business.

1. Targeting

As we worked with our financing clients, we made several surprising discoveries. One of the most shocking was just how few keywords actually produce conversions.

As it turns out, just 6% of the keywords in a typical AdWords account have ever produced a conversion (form fill, phone call, chat, etc). That means 94% of keywords are absolutely useless!

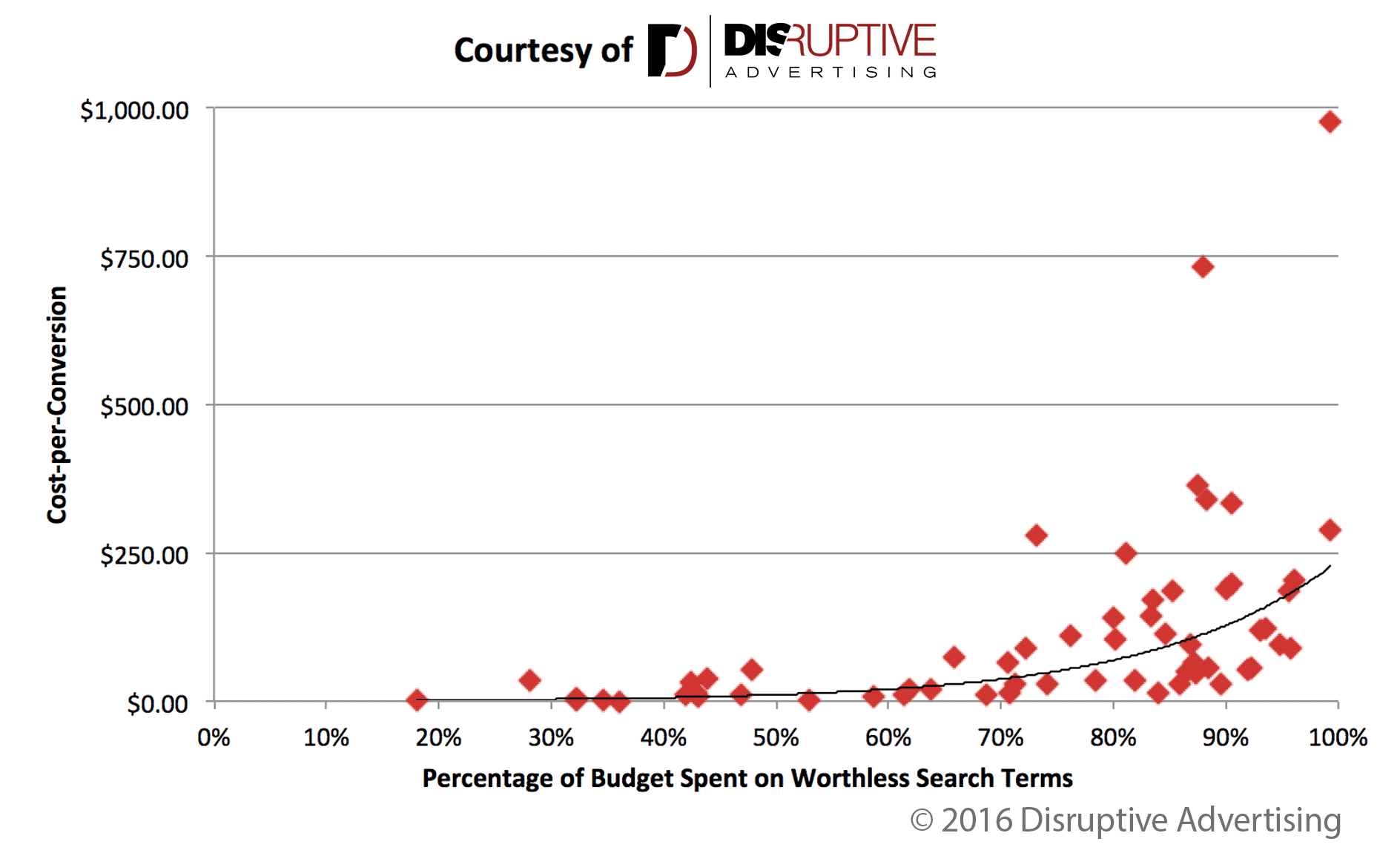

Now, that wouldn’t be a big deal if most of those useless keywords weren’t getting impressions or clicks. No wasted ad spend, no foul, right? The problem is, thanks to poor keyword targeting, 76% of ad spend is wasted on search terms that don’t produce conversions.

Talk about a waste of money!

All of that waste has serious consequences for your AdWords campaigns. Unfortunately, as you waste more of your ad spend on non-converting keywords and search terms, your cost-per-click gets exponentially higher:

In fact, for every 10% increase in wasted ad spend, your cost-per-conversion increases by 44-72%. So, if your current cost-per-conversion is $10.00 and your wasted ad spend goes from 30% to 40%, your new cost-per-conversion will be around $14.43-17.22. If it goes from 30% to the average of 76%, your cost-per-conversion could be more than $120!

Can you see why targeting is such a big obstacle for financing marketers?

Targeting the Right Keywords

Unfortunately, there is no perfect way to pick keywords. To identify the right keywords for your financing business, you’ll need to test a variety of different keywords.

If you’re already running AdWords campaigns, you’ve already been testing quite a few keywords, so you can simply start analyzing your existing keywords. However, if you’re new to AdWords, you’re going to need to come up with a detailed keyword list (click here for more info on how to do that) and start testing.

Pick your keywords, build some ads and landing pages around them and then run your ads for 2-3 months. I know, waiting is hard, but if you don’t give your ads at least 8-12 weeks, you won’t have enough data to identify your winning keywords.

Once you’ve done your time, open AdWords, click on the Keywords tab and create a filter for “Conversions < 1”. Run the report on your last 2-3 months of data.

From there, scroll down to the last row on your report to see how much you are wasting on non-converting search terms. If you divide that number by your total spend and multiply by 100%, you can quickly see how what percentage of your ad spend is being wasted on the wrong keywords and search terms.

Now that you know which keywords aren’t working, you can start eliminating them and truly optimizing your targeting. The good news is, that same exponential formula we talked about earlier also works in reverse. Every 10% of wasted spend you eliminate will decrease your cost-per-conversion by 44-72%.

Not bad, eh?

2. Time

Sadly, there’s a very simple reason why most financial marketers end up with so many useless keywords in their account. Most AdWords account managers simply don’t spend the enough time in their accounts to identify and eliminate those meaningless keywords.

Unfortunately, this lack of time and effort doesn’t just produce an account full of useless keywords—it also leads to waste in countless other areas.

To put it simply, running a good AdWords account is a lot like raising a child. It takes time, effort and—above all—consistency.

Raising a kid (especially a well-adjusted one) is a ton of work. You can’t just feed and clothe them and send them on your way. You have to spend countless hours getting to know them and their needs. If you don’t, both your life and their life will quickly spin out of control.

Same goes for AdWords accounts.

The thing is, 72% of AdWords accounts haven’t been touched in over a month. Only 10% of AdWords accounts get weekly attention.

Just imagine what would happen if you only paid attention to your kid every other month…

Not my kids…or my AdWords account, either.

If your AdWords account isn’t getting regular love and attention, it’s not going to be particularly well-behaved. It’ll irritate you (and your boss), bid on the wrong search terms and generally waste money.

You can’t just set up an AdWords account and feed it money—if you want it to perform, you have to give it time and attention.

Making Time for AdWords

The question is, how much time should you be spending in your AdWords account? After all, you’re a busy marketer, you can’t afford to spend all your time optimizing your AdWords account, right?

As a general rule of thumb, you should check up on your AdWords account at least once a week—especially if you’re spending more than $10,000 a month. But, if you really want to get the most out of your account, you should spend time in your account at least 3x/week.

If you’re launching new campaigns, you should be checking on things at least 3x/day. A new AdWords campaign is the financial marketing equivalent of an infant or toddler—it will wreak havoc if left unattended.

Now, just because you’re checking up on your account 3 times a day or week, that doesn’t mean you’re making a major change every time you log into AdWords. However, if you aren’t digging around on a regular basis, you will miss things and your account won’t perform the way you need it to.

3. Tracking

Of course, checking in on your accounts on a regular basis won’t do you much good if you don’t have great tracking in place. To put it bluntly, without great analytics, you won’t know what’s working…and what isn’t.

And, if you don’t know what isn’t working, how can you optimize your AdWords accounts?

Unfortunately, just 57.7% of AdWords accounts are tracking conversions. That means almost half of AdWords accounts are effectively running blind.

To make matters worse, of the 57.7% of AdWords accounts with conversion tracking, only half are actually tracking all of their conversions.

![]()

Now, this begs the question, how big of a difference does analytics tracking make? Well, according to Hubspot’s State of Inbound report, tracking your campaigns improves your odds of success by 1,700%.

1,700%? That’s a huge difference!

In fact, if we look at the numbers in Hubspot’s report a little differently and run a bit of math, that means:

[Tweet “Without good analytics, 97% of online marketing fails.”]

Essentially, trying to run an AdWords campaign without good tracking is the same thing as setting your money on fire.

Setting Up Tracking

The good news is, putting an effective tracking setup in place is fairly easy. AdWords has done a great job of making it easy to track conversions, which means there aren’t any good excuses for not setting up conversion tracking.

Explaining how to set up conversion tracking falls outside the scope of this article, but here’s a quick video on how to implement Google Tag Manager for free:

Once you’ve got Google Tag Manager set up, it’s easy to connect Google Analytics and AdWords.

Here’s how:

Ideally, you don’t want to stop at conversions, though. The ultimate goal of your marketing is sales, not conversions, so you’ll want to use a CRM to track your AdWords clicks all the way through to the revenue they generate. That way, you can optimize for return-on-investment, not just clicks or conversions.

At the end of the day, setting up analytics is setting your B2B business up for success. You might not always get the kind of results you want, but if you have quality tracking in place, you can learn from your mistakes and keep improving until things start working.

POutting AdWords to Work

At Disruptive Advertising, we have had a ton of success helping financing businesses grow using AdWords. However, we’ve also seen countless financial marketers struggle with AdWords because they weren’t addressing the 3 T’s: targeting, time and tracking.

The good news is, if you can nail the 3 T’s, AdWords can be an incredibly powerful growth engine for financing business. What will it do for yours?

By the way, if you’d like help setting up or running an effective AdWords account for your financing business, let me know here or in the comments! Financing businesses are among our favorite clients, so we’d love to have the opportunity to help you grow.

You’ve heard my two cents, now it’s your turn. What are some of the obstacles your B2B business faces? Have you tried AdWords? What was your experience?