Is Your Target Cost-Per-Lead Realistic?

by Aden Andrus • October 21, 2019

If you’re trying to drive leads for your business online, there’s one marketing metric that you live and die by: cost-per-lead.

Now, if you’re good at your job, you know that ultimately your most important metric is your cost-per-sale or cost-per-acquisition, but more often than not, that’s directly related to your cost-per-lead (CPL). And, since your acquisition cost usually depends heavily on factors outside of your control (aka, your sales team), you focus on the metric you can control: cost-per-lead.

But here’s the thing: how do you know if your target cost-per-lead is actually realistic?

Does your cost-per-lead actually make sense? Will it deliver profitable results for your business? Is it actually achievable? Picking a target cost-per-lead is important, but unfortunately, many business owners and marketers tend to pick their CPL the wrong way. As a result, their campaigns struggle and they have a hard time getting the results they need from their campaigns.

In this article, though, we’re going to show you how to figure out what the right target cost-per-lead is for your business. We’re going to go over why this number matters and how to calculate an appropriate CPL that will help you achieve your business goals.

Sound like a plan? Let’s get started!

Why Cost-Per-Lead Matters

So why is it so important to pick the right target cost-per-lead, anyways? I mean, can’t you just pick a number based off of a percentage of your revenue and call it good?

Well, that’s certainly one way to do it, but when you choose your target CPL based on arbitrary criteria…you get arbitrary results.

That’s not a good way to grow your business.

Instead, your target CPL needs to based on your business goals—not just some fixed percentage. If your goal is to maximize profits, you’re going to have a very different CPL than you would have if you’re trying to double your annual revenue.

Picking the right target CPL comes with other added benefits, too. If you know what your goals and what you’re willing to spend to achieve them, it’s easy to evaluate your various marketing efforts and determine where to spend your marketing budget.

For example, let’s say your goal is to have a target cost-per-lead of $20. On Facebook Ads, you can get new leads for $50, but you only get a few a month. On Google Ads, you pay about $25 a lead, but you can have as many leads as you can afford.

With an arbitrary target CPL of $20, you’d have to say “no” to running Google Ads—even if you’d still make a profit on them! However, if your primary goal is to grow, you might decide to opt for slimmer margins now while you grow and decide to put money into Google Ads.

Because so many marketing decisions revolve around your target CPL, it’s absolutely essential that you choose your target CPL in the right way and for the right reasons. Otherwise, you’ll end up optimizing for the wrong things in your marketing!

Calculating the Right CPL for Your Business

Fortunately, if you know what you’re doing, it’s actually fairly easy to choose the right CPL for your business needs. You simply need to know a few things about your business and what your goals are.

How Much Can You Afford to Spend?

Before you choose your target CPL, you need to know how much you can afford to spend to get a new customer. To figure that out, you need to know the average lifetime value of a new customer.

Put simply, customer lifetime value (CLV) tells you how much you can expect to make from a new customer. For ecommerce businesses, this is often a one-and-done affair. A customer makes a purchase and never comes back.

For lead generation businesses, however, things are a little more complicated. You may have customers who subscribe to your services (think Netflix) or customers who repeatedly hire you to do things for them (think services businesses). All of that factors into your customer lifetime value.

If your average customer pays you $14.99 a month for 5 years, is that customer worth $14.99? No! That’s just what you make off of them in the first month.

In the scenario above, a new customer is actually worth $899.40 to your business, so you can afford to spend a lot more than $14.99 getting a new customer. Sure, you might lose a little money at first, but you’ll more than make up for it in the long run.

Calculating Your Average Customer Lifetime Value

There are a lot of ways to calculate CLV, but here’s a fairly simple way to think about it:

(Average monthly revenue per customer / churn rate) = CLV

To show you how all of this works, let’s say that you’re the marketing director for ACME widget—the world’s foremost supplier of business widgets. Your company has a subscription model where businesses sign up for monthly widget deliveries.

Calculating the average monthly revenue per customer for ACME Widgets is fairly easy. Just take your average monthly revenue and divide it by your average number of monthly customers. So, if you normally make $50,000 a month from 1,000 customers, your average monthly revenue per customer is $50.

Churn rate can be a bit more difficult to figure out, but it’s still fairly straightforward. Simply subtract the number of repeat customers you get in a given month from the total number of customers you had in that month and divide by the total number of customers you had in that month. So, if you have 1,000 customers a month and 950 of those customers are repeat customers, your churn rate is 0.05 (or 5%).

Once you have those numbers, all you have to do is follow the formula above to get your CLV. In the case of the hypothetical scenario we’ve been discussing, the average customer lifetime value is $1,000 ($50 / 0.05 = $1,000). Easy enough, right?

Calculating Your Average Profit per Customer

Once you know what your CLV is, you can figure out what your actual profit margin is. To get at that number, you need to figure out exactly how much it costs to take care of a new customer throughout their entire lifetime as a customer.

So, if it costs you $5.00 a month to cover an existing customer’s needs and that customer stays with you for an average of 20 months, your fulfillment costs are $100.

Then, on top of that, you need to add in any other fixed costs that your business needs to cover and divide that by your average number of monthly customers. For example, in the scenario we’ve been discussing, if salaries, rent, utilities, etc cost you $30,000 a month, than that works out to $30 per customer per month.

Once you know what your fulfillment and fixed costs per customer per month are, use the following equation to calculate your average profit per customer.

CLV – (Average monthly costs per customer / churn rate) = Profit per customer

For example, in our hypothetical scenario, the average CLV for a new customer was $1,000. It costs an average of $5 a month to take care of a customer and $30 a month per customer to keep the business running, for a total average monthly cost per customer of $35. Over the lifetime of a customer, that works out to $700 ($35 / 0.05 = $700) in costs.

Subtract that figure from our average CLV and you get $300 of profit ($1,000 – $700 = $300). So, as long as our theoretical business doesn’t spend more than $300 to produce a new customer, they’re in the black!

What Can You Afford to Spend on a New Lead?

Once you know how much you can afford to spend on a new customer, you need to work backwards to figure out how much you can spend on a new lead.

It would be nice if every lead became a new customer, but as anyone who’s tried to drive leads for their business knows, it’s never that easy. To calculate how much you can afford to spend on each new lead, follow the formula below:

Profit per customer * (Monthly sales closed / Monthly leads) = Maximum cost-per-lead

So, if our hypothetical business gets 500 leads a month and closes 50 of them, they can afford to spend $30 per lead ($300 * (50 / 500) = $30). If they spend any more than that, they’re losing money on every customer.

How Much Do You Want to Spend?

Now, knowing how much you can afford to profitably spend to get a new customer still doesn’t answer the question, “What should my target cost-per-lead be?”

As we mentioned earlier, the answer to that question depends on your goals.

I’ve worked with SaaS businesses that were willing to spend so much on marketing that they were actually taking a short-term loss to build up their customer base. Why? Because they needed to prove that their business could work to potential investors. Because their goal wasn’t to actually make money, their target cost-per-lead was actually higher than their profit margin!

Now, do I recommend that as a general business practice? Of course not. But, it just goes to show how important your goals are in choosing the right target cost-per-lead.

For example, if our theoretical business wants to get aggressive about growth, they might decide to aim for a $25 cost-per-lead. It won’t leave them a lot of profit margin, but it gives them a lot more money to play with on the marketing side of things.

On the other hand, if the goal was to maximize profit, they might shoot for an average cost-per-lead of $10. They probably won’t get a ton of leads, but as long as they can cover their churn rate, they’ll make at least $5,000 a month in profit.

Taking Things to the Next Level

So far, everything has been fairly straightforward. However, in our discussion, we’ve failed to account for one very important thing: not all of your customers will be worth the same amount.

Choosing your target CPL based on your average customer lifetime value is all well and good, but what do you do when certain types of customers are worth a lot more to your business? If this is true for your business, you need to break out your target CPL calculations by types of customers.

To show you how this works, let’s revise our ACME Widgets scenario. ACME sells the world’s very best widgets, after all, so their average customer lifetime value isn’t a measly $1,000…it’s $24,000.

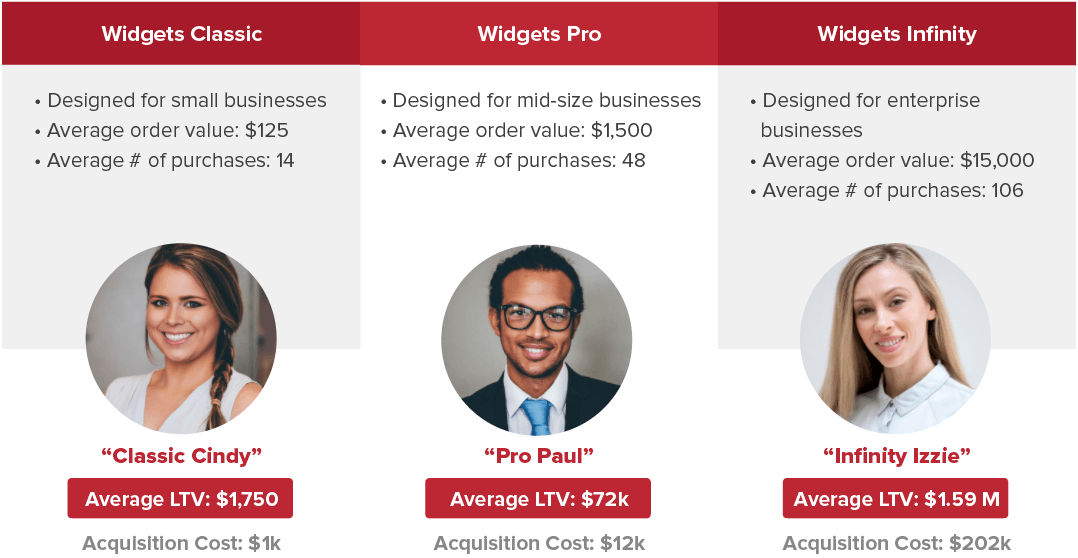

As you try to figure out your target CPL, you do a little homework and discover that ACME has three primary types of buyers (aka, “buyer personas”):

All of a sudden, the story becomes much clearer. Using our original set of calculations and your overall average LTV of $24,000, you might have decided that you can afford to spend $4,000 to acquire a new customer (or $400 per lead with a 10% close rate).

However, when you take each of these types of customers’ specific LTVs into account, it quickly becomes clear that you can afford to spend a lot more on a new “Infinity Izzie” customer than you ever would on a “Classic Cindy”.

In fact, your whole marketing strategy for “Infinity Izzies” is probably very different than it is for “Classic Cindy’s”. That’s something you have to account for as you figure out your target CPL.

So, instead of picking a flat $4,000 target acquisition cost, you’d want to break things out this way:

The average acquisition cost across all of these buyer personas still works out to $4,000, but now you know how much you can afford to spend to acquire each type of customer. With that knowledge in hand, you can be a lot more thoughtful and deliberate about how you approach your target cost per lead.

For example, your target CPL for “Infinity Izzies” may be 100x higher than your target CPL for “Classic Cindys”. But, it doesn’t really matter because “Infinity Izzies” are so much more profitable for your business.

Do you see why it’s so important to take your time and consider all of these different factors when you’re choosing your target CPL? If you simply said, “ACME Widgets can afford to spend an average of $400 to get a new lead”, you’d probably end up closing down most of your marketing channels and campaigns that produce Infinity Izzie leads. That would cripple your business!

But, by taking your whole business and customer base into account when determining your target CPL, you can be much more methodical and effective with your marketing. It takes more work, but it’s a much better move in the long run.

Conclusion

Choosing the right target CPL for your business takes a lot more time and effort than simply choosing an arbitrary number based on a specified percentage of revenue (which is how so many businesses do it). If you want real results from your online marketing budget, though, it’s time and effort you need to invest.

By the way, if you’d like some help identifying the right target CPL for your campaigns, let us know here or in the comments. We’d love to help!

How do you choose your target cost-per-lead? Do you agree with the ideas presented here? What advice would you add? Leave your thoughts in the comments.