How to Conduct Market Research in 4 Easy Steps

by Ana Gotter • October 29, 2018

You know your product and service insight and out. You know what it’s capable of, and how it can help people. But how well do you actually know the audience that you want to sell it to?

Understanding your target audience is going to be an important part of building and promoting any business. You’ll want to know who your audience is, how your product or service fills their pain points, how to get in touch with them, and how to set yourself apart from the competition.

Market research is the key to gaining this knowledge. In this post, we’ll go over the purpose of market research and how to conduct it in just a few quick and easy steps.

What is the Purpose of Market Research?

Market research is the systematic approach used to gather information about your audience, your competition, your business and how the three all interact. It’s a crucial step in developing everything from your unique selling proposition to actually figuring out what platforms to connect with clients on.

You’ll also need to understand where the market actually stands. What is your competition doing? Where are their price points at and what offers do they have that your shared customers might find appealing?

There’s obviously a lot of information that needs to be conducted in order to properly conduct market research. It can actually take months to get the initial steps underway, and in some cases it may take years to get a full, complete understanding of what you’re looking for.

Most businesses, however, do not have eight months (let alone several years) to conduct market research, particularly in the early stages of their businesses. They need to find the information—and quickly—so we’ll look at how to gather the key information that’s essential to new market research in efficient ways.

Primary and Secondary Sources: What Should I Use?

Before we dive in to the step-by-step process, it’s important to go over primary and secondary sources for marketing research, because the types of sources you use can make a difference in the quality or reliability of the information.

Primary sources come first-hand from talking to people directly. Think focus groups and survey responses. These sources are immensely helpful because you’re getting the information you need directly from the horse’s mouth. The only downside to primary sources is that it may provide a more isolated look at the big picture if not done well. If only certain types of customers will fill out a survey or if your focus group is too small, the data may be skewed.

Secondary research comes from already-assimilated data that you can access. Think anything that you can find online. Data, reports and more. Secondary research can sometimes provide more information and be more easily accessible.

When you’re conducting market research quickly, trying to utilize both primary and secondary research will be important. Send out surveys to your customers and try to get feedback while also pouring over all the data available to you. Primary research will enable you to get the most details possible and the secondary research can help you see what you’re missing and fill in any of the information gaps. This will give you the most actionable data as quickly as possible.

Conducting Market Research in 4 Fast Steps

When you’re conducting market research, there are a few preliminary steps that you’ll want to take before you can even start to figure out what your audience wants. First, for example, you need to figure out who that audience is.

1. Identify Your Target Audience

Who is your target audience? Identifying what audience you want to reach will be a huge part of market research, because you can’t conduct it properly without that information.

Who is your product or service meant to help? What niches or groups of people will it appeal it? What do they need and how can you connect with them? Are they most likely to engage through email, or Facebook or LinkedIn?

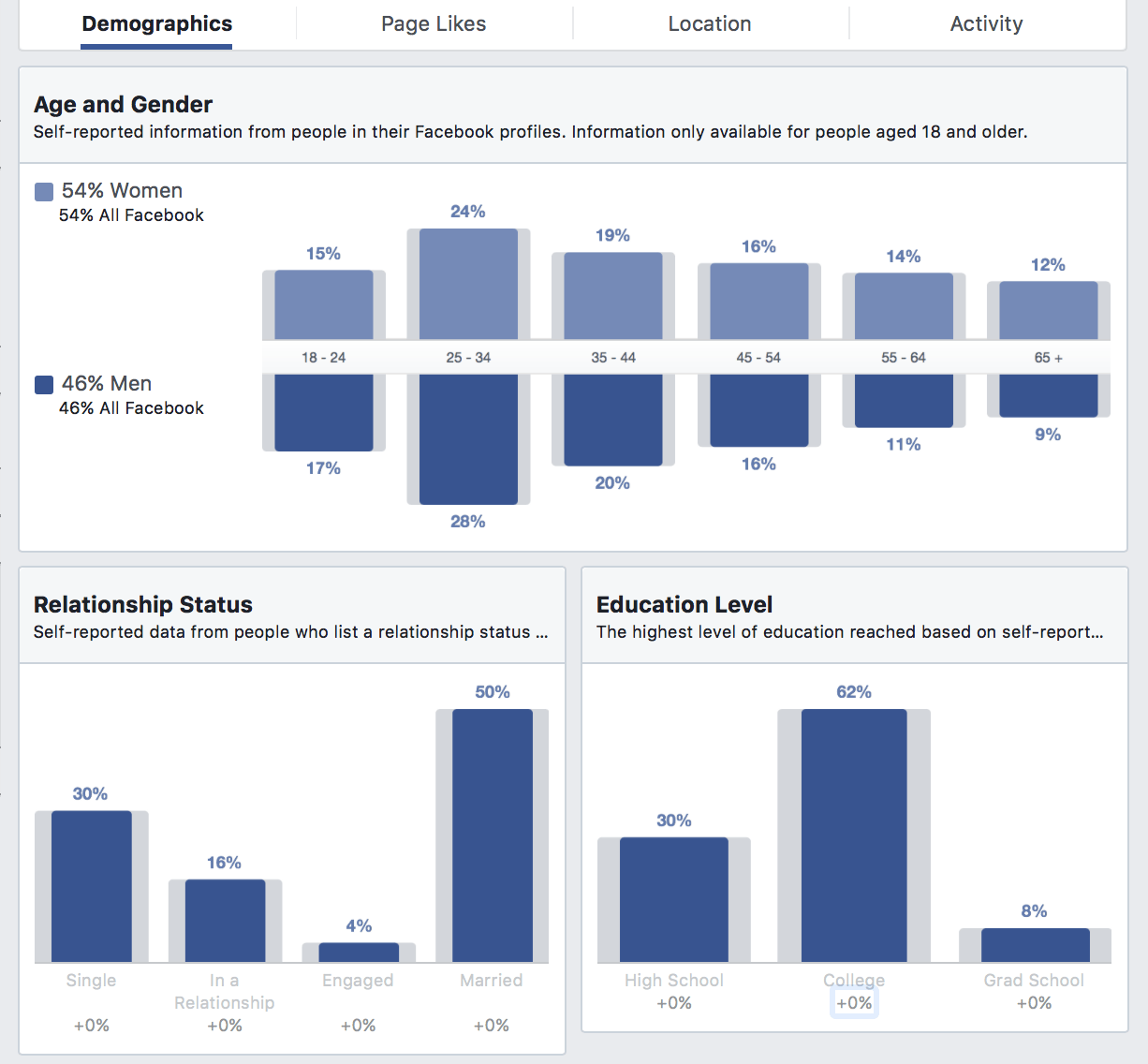

When you’re identifying your target audience and getting ready to create buyer personas, you should be able to answer all of the following questions:

- Age

- Location

- Gender

- Income

- Family Size/Relationship Status

- Education

- Job title

- Interests

- Biggest challenges and goals

You will likely have several distinct audiences, so you may need to do this exercise several times in order to create stronger and more accurate buyer personas.

Use a mix of surveys, recon data pulled through Facebook Pages or groups and their analytics, and personal experience to fill in the gaps here.

2. Check Out Your Competition

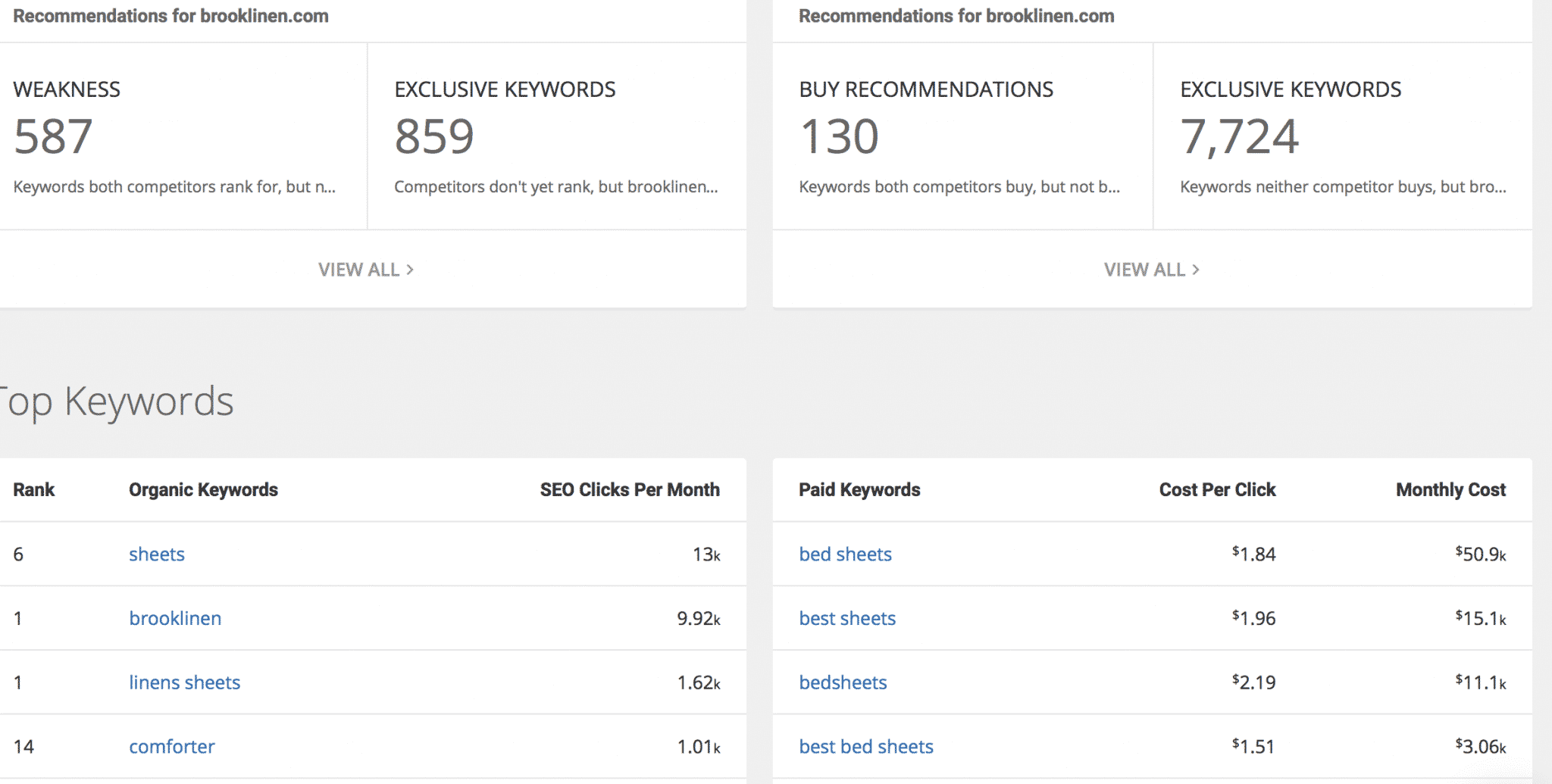

Competitor research is an important part of market research because it helps you actually understand the market. You can see who else is out there, what they’re offering, how they’re offering it and for what price. You want to understand the USPs that they’re using and the general value propositions that they’re using to appeal to your audience.

This can help you gauge important information such as:

- The price you can charge for your product. You don’t have to instantly undercut your pricing to beat your competition. If you sell your product as a “luxury” option and there isn’t one in the space, you could get away with charging more.

- What value propositions you can use to stand out from the competition and attract customers.

- What offers specifically your target audience may be responding to. Are they looking for free trials, low costs or consultations on top of the product or service?

- The marketing campaigns that your audience may be responsive to. If your biggest competition also has the best blog, that can may indicate that it’s time to invest in content marketing. If you notice that they’re aggressively going after Google Ads, on the other hand, see if you can do some research to steal their own keywords out from under them.

There are several tools you can use for this stage. I always recommend SpyFu, because it’s an excellent option that will show you everything that specific competitors are doing for their site and search marketing—including the keywords they’re ranking for.

In order to look at ad strategies, I recommend checking out their Facebook Page and then taking a look at the “Info and Ads” section. This gives you a look at all the ad campaigns—and the offers—they’re currently running and provides valuable data.

3. Engage With Your Audience

At this stage, you want to reach out to your audience and learn more about what they find valuable in your product or service, how it’s helping them and what they’d like to see. This is true whether you want to just get a feel for how your customers feel about your business or if you’re ready to develop additional products or services and are wondering if they’d be a good fit.

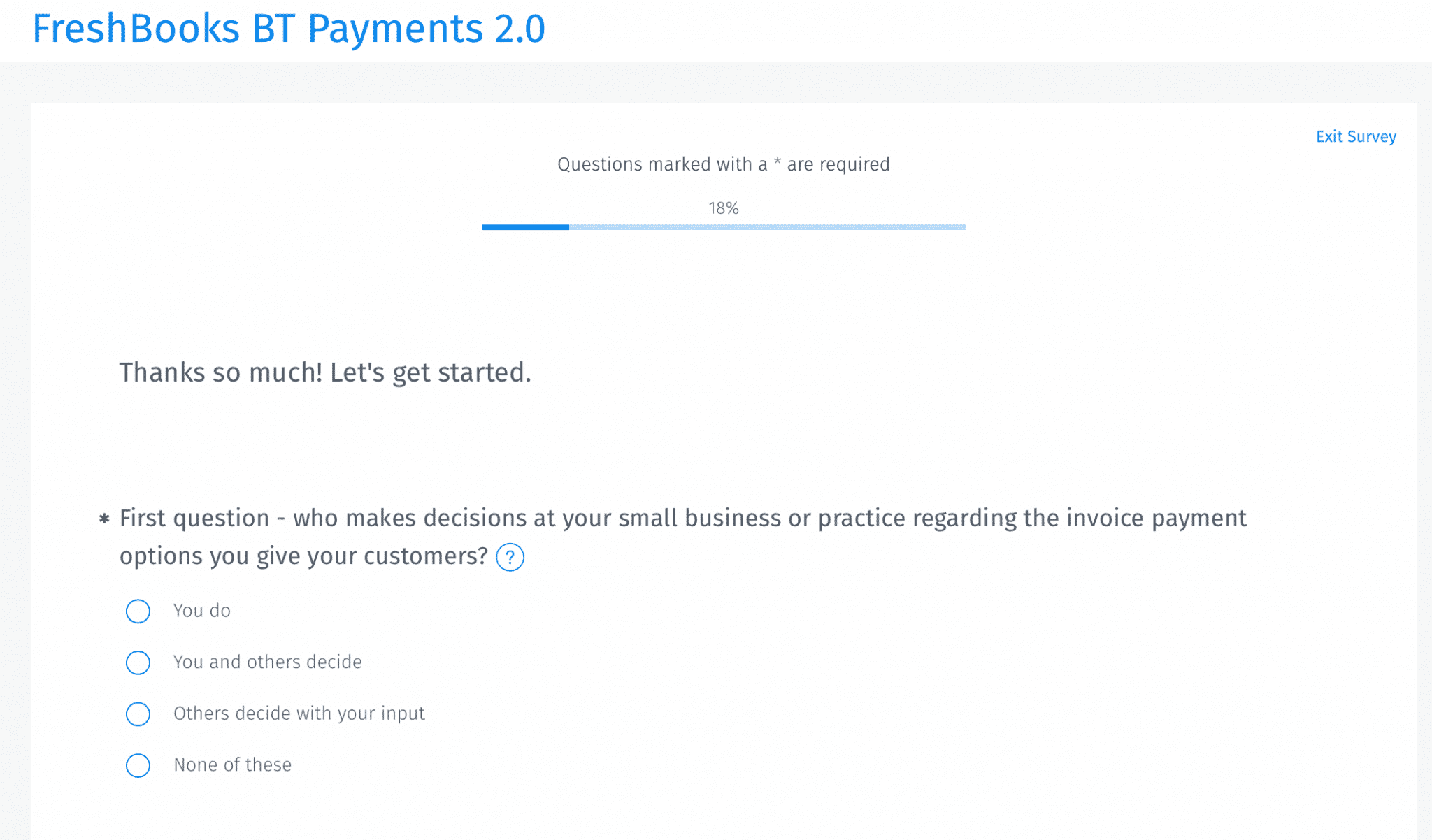

Talk directly with currently customers and—if needed—relevant audience members. Compiling focus groups of people who aren’t already connected to your brand can be a good option, even if it’s more expensive and time consuming. You can hire a company to help with this and offer free trials or samples in exchange for an honest (and private) review. You can also send surveys directly to existing customers, or even take an informal poll in your business’s Facebook group or on your Page.

Most people love to give their opinion—take advantage of that. In many cases, the answers they give may surprise you or give you entire ideas about needs and pain points that aren’t being addressed not only by you but anyone else.

At this stage, try to qualify the individuals you’re engaging with. Do they fit into a high value audience? Which niche do they belong to? This will impact how you interpret the data.

4. Compile the Data

By now, you already have a lot of data on your hands. What I recommend doing is carefully organizing it and sorting it out by relating the information at hand to the buyer personas that you researched and developed in step 1.

What Does This Look Like?

Let’s say that you have your own hardware and home improvement store. You may have found that you have three distinct buyer personas:

- Needs Paint Patty, who just comes in for occasional products like paint to spruce up an apartment or a lightbulb for her desk lamp. These customers are younger, on a budget and don’t have serious home improvement needs.

- Homeowner Harry. These customers want to find a home improvement store that’s close to where they live and affordable, because being a homeowner means that you always need to keep making purchases for everything that breaks. They value customer service and quality and they’re likely to become loyal customers if you can capture them. They are typically lower and upper middle class and have basic knowledge of how to fix things around their homes.

- Contractor Carl, who wants quality but wants his contractor discounts and to be able to get the products they need quickly and potentially in bulk. It’s harder to get these individuals on board, because the bigger names sometimes have more items in stock. They need more specialized items or tools than most homeowners need.

Needs Paint Patty doesn’t care about your general contractor 15% discount (which beats the competitors), or even a customer loyalty program like Homeowner Harry does. Even when it comes to painting, Patty may pick paint that just lasts for a few years before she moves. Homeowner Harry never wants to have to the go through the ordeal of taping up every light switch in his house again and wants it to last until he’s dead.

Placing the right data with the right audience niches will be crucial, because it will affect how you market to certain individuals and the offers that you have available.

Conclusion

Market research should be conducted before you start creating your marketing content—including your website—so that it can properly inform and direct it. You need to consider your specific audience when creating everything from your tagline to what marketing platforms you’ll use, so that information has to come first. You’ll also want to update your market research on a regular basis to make sure that you’re still focusing on the right audience and in ways they need that you uniquely can fulfill. This will give you the best results moving forward.

What do you think? How do you conduct market research for your business? Which steps do you believe are most important? Do you ever use a third party to conduct the research for you? Let us know what you think in the comments below!